Equity Crowdfunding – The International Scene. Part 3

The JOBS Act (Jumpstart Our Business Start up Act) was signed into law by Obama back in April 2012. Following the nascent success of equity crowdfunding in the UK, there was hope that this Act marked the dawning of a new age for US SMEs and start ups.

However the very heavy restrictions on who could invest and under what SEC regulation has meant that Ecf has not taken hold here ….yet.

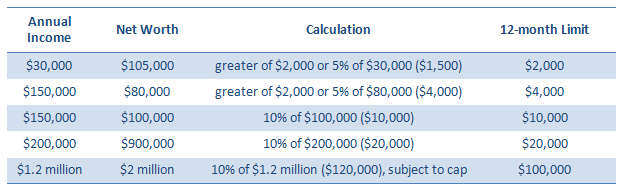

A new law due to come into force on the 1st May this year will allow US citizens to take part in purchasing equity from SMEs and start ups. Whereas the current regulations mean you have to have resources of over $1m to be eligible for this type of investment, from the 1st of May the picture will change –

So for example, someone earning $30k to $150k will be able to invest up to $2,000 per annum. So it’s not anywhere close to the situation we have here but it is seen as progress.

Companies and investors have to go through on line portals to carry out ECF and these are strictly regulated by the SEC. There has been much debate in the US about the SEC restrictions and the picture is not clear but there will now be tiered financial disclosure levels - see below.

Tiered financial disclosure

The minimum level of financial disclosure required by the company depends on the amount of money being raised or raised by the company in the prior 12 months:

- $100,000 or less – financial statements and specific line items from income tax returns, both of which are certified by the principal executive officer of the company.

- $100,000.01 to $500,000 – financial statements reviewed by an independent public accountant and the accountant’s review report.

- $500,000.01 to $1 million – if first time crowdfunding, then financial statements reviewed by an independent public accountant and the accountant’s review report, otherwise financial statements audited by an independent public accountant and the accountant’s audit report.

Calculations we have seen suggest that a company wishing to raise over $100k (~£70k) will incur non-refundable fees upfront of around $15k just to adhere to these disclosure rules. Quite simply that is not going to encourage many small firms to take part. From experience in the UK, very few companies now attempt to raise less than £70k because of the effort involved. At least here the ECf campaign is free and fees are only paid if it is successful. To ask small companies or start ups to spend a chunk of their working capital on a campaign that may well fail simply will not work.

The Canadians have taken a similar path. Their regulations, the Start Up Crowdfunding Exemption and the Integrated Crowdfunding Exemption, are very complex and use a mix of accredited investors to restrict users and investment restrictions per annum combined with reporting requirements to restrict companies. It is a bit of minefield with multiple ways of trying to raise Ecf but in effect very few if any that are recognisable as real ECF.

.jpg?width=5184&height=3456&name=Ambassador_Johnson_meets_Chancellor_Hammond_(36560214560).jpg)